- Vehicle Guide

- Passenger cars

- Estate

- Electric

- 4x4 SUVs

- Suzuki Jimny 4x4

- Dacia Duster 4x4

- Suzuki Vitara 4x4

- Suzuki Vitara auto 4x4

- Dacia Bigster 4x4

- Kia Sportage 4x4 Auto

- Kia Sportage PHEV 4x4 auto

- Mitsubishi Outlander PHEV 4x4 auto

- Toyota Rav4 4x4

- Toyota Rav4 4x4 auto

- Kia Sorento 4x4 auto

- Toyota Landcruiser 150 4x4 auto

- Toyota Landcruiser 250 4x4 auto

- Landrover Discovery 5 4x4 auto

- Landrover Defender 4x4 auto

- Prestige

- Minivans

- 4x4 Camper

- Motorhomes

- Driving in Iceland

- Our services

- Locations & Hours

- Travel Inspiration

- South Iceland: A complete guide

- Reynisfjara Beach in Iceland - Your Guide to a Safe Visit

- Best Times to Visit the Golden Circle in Iceland

- North Iceland: A Complete Guide for Drivers

- East Iceland A Complete Guide for Drivers

- West Iceland The Complete Driver’s Guide

- Your Ultimate Guide to Exploring Iceland’s Ring Road

- Driving the Diamond Circle in Iceland: Your Ultimate Guide

- Driving Iceland's Golden Circle: Your Ultimate Guide

- A 10-Day Itinerary in Iceland: Tips + Ideas

- The Perfect Itinerary for 7 Days in Iceland

- The Best Time to See the Northern Lights in Iceland with a Rental Car

- Renting a Camper in Iceland: The Complete Guide

- Getting to Iceland: A Comprehensive Guide on How to Reach the Land of Fire and Ice

- Nature Bath Locations in Iceland: A Complete Guide

- Iceland with Kids: A 5-Day Self-Drive Itinerary

- Winter Driving in Iceland: A Comprehensive Overview for Foreign Tourists

- The Total Solar Eclipse in Iceland – August 12, 2026

- Exploring Iceland's National Parks on a Self-Drive Adventure

- Exploring Iceland's Wonders: A Comprehensive Guide to Activities and Car Rentals

- Springtime in Iceland – Your Comprehensive Travel Guide

- Exploring Iceland's Most Popular Highland Routes

- The Pearls of Westfjords: The Ultimate Guide

- Exploring Iceland's Hidden Gems | Off-the-Beaten-Path Adventures

- Driving in Iceland in June: Tips for a Safe and Scenic Summer Road Trip

- Driving in Iceland in July: Tips, Routes & Rentals

- Driving in Iceland in August: Late-Summer Freedom on the Open Road

- Guide to Skaftafell Iceland Self-Drive A Journey Through Fire and Ice

- Eco-Friendly Road Trips in Iceland, Sustainable Travel Tips

- Photographer’s Paradise Top Scenic Drives in Iceland for Stunning Shots

- Iceland's Folklore and Legends A Road Trip Through Mythical Sites

- Iceland’s Midnight Sun and How to Make the Most of 24-Hour Daylight

- Exploring Iceland’s Viking Heritage: Top Historical Sites

- Chasing Waterfalls: A Road Trip to Iceland’s Most Spectacular Cascades

- Iceland's Volcanic Wonders: A Self-Drive Tour of Active and Dormant Volcanoes

- Tee Off in the Land of Fire and Ice: A Guide to Golfing in Iceland

- Birdwatching in Iceland: Puffins and Beyond

- Iceland’s Diverse Beaches: Beyond the Black Sands

- Icelandic Horses: The Unique Breed of the North

- Beyond the Ring Road: Iceland’s Hidden Scenic Drives

- Iceland’s Ice Caves: A Year-Round Adventure

- Wildlife Watching in Iceland: Where and When to Go

- Iceland’s Hidden Hot Springs: A Self-Drive Guide to Secret Soaks

- Navigating Iceland’s Weather: What to Expect Each Season

- Tröllaskagi Peninsula: Iceland’s Mountainous Marvel — A Scenic Road Trip with Höldur

- Mastering Iceland's Roundabouts: A Driver’s Guide

- Essential Tips for Renting a Car in Iceland

- Navigating Iceland’s One-Lane Bridges: Your Guide to Safe and Scenic Crossings

- Exploring Iceland’s Film Locations by Rental Car

- 5 Must-Visit Destinations Within Two Hours of Keflavík Airport

- Seasonal Car Rental Tips for Iceland’s Summer Festivals

- Understanding Iceland's F-Roads: How to Drive Safely Into the Highlands

- What Makes Iceland Unique: Top 15 Highlights for an Unforgettable Journey

- Driving and Hiking in Harmony: Explore Iceland's Natural Wonders with Höldur Car Rental

- Best Car to Rent in Iceland?

- Avoiding Common Car Rental Mistakes in Iceland

- Making Your Car Rental in Iceland Child-Friendly: Tips for Stress-Free Family Travel

- Exploring Akureyri, Iceland’s Northern Gem, with EasyJet and Europcar

- Renting a Manual or Automatic Car in Iceland

- Discover the Arctic Coast Way in Iceland with Höldur Car Rental

- How to Save on Fuel Costs During Your Iceland Road Trip

- Electric vs. 4x4 Rentals in Iceland: Which is Right for Your Trip?

- Top Scenic Detours Off Iceland's Ring Road

- Top Safety Tips for First-Time Drivers on Iceland’s Roads

- Cultural Pit Stops Along Iceland’s Ring Road

- Your Guide to Exploring Stuðlagil Canyon by Car: Iceland’s Basalt Beauty Awaits

- Day Trip Ideas From Reykjavik by Rental Car

- Visit Glymur Waterfall: The Ultimate Self-Drive Adventure from Reykjavík

- Discover the Volcanic Wonders of Lake Mývatn by Car

- Discovering the Magic of Snæfellsnes Peninsula by Car

- Your Self‑Drive Guide to Gullfoss Waterfall

- A Guide to Seljalandsfoss Waterfall in Iceland: Explore by Car

- Exploring Reykjanes Peninsula A Self Drive Guide

- Exploring Iceland Landmannalaugar by 4x4

- A Beginner's Guide to River Crossings in Iceland

- Best Car Rental Offers for Iceland’s Summer Adventures

- Your Self‑Drive Guide to Þingvellir National Park

- Your Ultimate Guide to Geysir, Iceland: All You Need to Know

- How to Pay for the Vaðlaheiðargöng Tunnel

- Your Guide to Visiting Jökulsárlón Glacier Lagoon

- The Diamond Beach in Iceland: A Sparkling Wonder Worth Visiting

- Parking fines in Iceland: how to pay and what to do if you receive one

- Where to find overnight parking in Reykjavík: a local’s guide for travellers

- How to park for free in Reykjavík: tips to save on your Iceland trip

- How to pay for parking in Reykjavík - A friendly guide for drivers in Iceland

- Game of Thrones Filming Locations in Iceland: A Self-Drive Guide

- How to Choose the Right Car Rental at Keflavík Airport

- Flying Within Iceland: Your Guide to Domestic Routes and Regional Airports

- Top 3 Must-See Attractions on Iceland's Golden Circle

- Hidden Gems Along the Golden Circle Route

- Your Essential Guide to Iceland: Currency, Culture, and Car Rental Tips

- How to Plan the Perfect Golden Circle Self-Drive Tour

- The Comprehensive Guide to Rental Car Sizes at Keflavik Airport

- Húsafell & Hallmundarhraun: Hidden Lava Field Adventures by Car

- Iceland Weather by Month: What to Expect and How to Drive Safely with Holdur Car Rental

- A Guide to Iceland’s Quirky Roadside Attractions

- Exploring Iceland’s Lava Tubes | Self-Drive Cave Adventures with Höldur Car Rental

- Coolcation in Iceland: Self-Drive Your Summer Escape to the North

- Driving Iceland’s Coastal Roads: A Guide to Lesser-Known Peninsulas

- Top Tips for Driving in Iceland Safely Year-Round

- The Best Rest Stops and Viewpoints Along Iceland's Ring Road

- Driving in Iceland in September: Embrace the Autumn Adventure

- Your Guide to Exploring Fjaðrárgljúfur – South Iceland’s Fairytale Canyon

- Explore Reykholt on a Self-Drive Tour in Iceland

- How to Choose the Right Insurance for Your Iceland Car Rental

- Hiking Múlagljúfur Canyon: Iceland’s Hidden Gem You Can’t Miss

- Understanding Iceland's Weather and How It Affects Driving Conditions

- Dyrhólaey: A Complete Self-Drive Guide to Iceland's Breathtaking South Coast

- Where to See Iceland’s Tectonic Plates Up Close

- Scenic Journey on Kjalvegur Road 35 Reykjavik to Akureyri

- Guide to Visiting Svartifoss with a Rental Car

- Kerið Crater Lake in Iceland: A Self-Drive Guide

- Your Complete Guide to Stokksnes, Iceland with a Rental Car

- Hengifoss Waterfall in Iceland: The Ultimate Self-Drive Guide

- Your Complete Guide to Visiting Skógafoss Waterfall with a Rental Car

- Into the Heart of Þórsmörk: Iceland’s Valley of Thunder

- Dynjandi Waterfall in Iceland: The Ultimate Self-Drive Guide

- Visiting Ásbyrgi Canyon in North Iceland by Car: A Complete Self-Drive Guide

- Driving in Iceland in October: Embrace the Autumn Transition

- Hraunfossar: Iceland’s Hidden Gem for Self-Drive Travellers

- Barnafoss Waterfall: Iceland’s Raging Cascade with a Legend

- Driving in Iceland in November: Your Complete Guide to a Spectacular Autumn Adventure

- Fishing in Iceland: All You Need to Know

- Öxarárfoss Waterfall in Iceland: A Self-Drive Guide with Höldur

- Life in Iceland: Essential Guide to Living in the Land of Fire and Ice

- People of Iceland - 12 Fun Facts About Icelanders

- Glaumbær Turf Houses: A Self-Drive Guide to Iceland’s Living History

- Húsavík: Whale Watching Capital of Iceland

- Svínafellsjökull Glacier: A Self-Drive Guide to Iceland’s Ice Giants

- Kirkjubæjarklaustur: A Historic South Coast Gem

- Vík í Mýrdal: South Iceland’s Coastal Treasure

- Namaskard: A Self-Drive Guide to Iceland’s Geothermal Wonderland

- Laufás Heritage Site: Where Iceland’s Past Lives On

- Navigating Iceland's Gravel Roads: Tips for a Safe and Smooth Drive

- Iceland's Best Stargazing Spots for Self-Drive Travellers

- Iceland's Best Picnic Spots: Scenic Stops for Self-Drive Adventures

- Top 5 Family-Friendly Hiking Trails Accessible by Rental Car

- 15 Tips for Travelling to Iceland

- How to Plan a Winter Photography Road Trip in Iceland

- Visiting Gljúfrabúi Waterfall — A Self-Drive Guide

- How to Spot Puffins in Iceland: A Self-Drive Adventure

- Your Essential Guide to Winter Tyres and Safe Driving in Iceland

- Iceland’s Most Active Volcanoes: A Self-Drive Guide

- Iceland’s Most Scenic Bridges and River Crossings: A Self-Drive Guide

- Iceland’s Most Instagrammable Spots for Self-Drive Travellers

- How Cold Is It in Iceland During Winter? A Self-Drive Guide

- Explore Dimmuborgir: A Self-Drive Guide to Iceland's Dark Castles

- The Ultimate Guide to Iceland’s Top 5 Waterfalls by Car

- Iceland’s Best Scenic Routes for Autumn Foliage: A Self-Drive Guide

- The Best Time to Visit Iceland for Self-Drive Travellers

- Self-Drive Adventures to Iceland’s Remote Lighthouses

- Selfoss Waterfall Self-Drive Guide: Explore Iceland Your Way

- All About the Icelandic Sheep

- Vestrahorn: A Self-Drive Guide to Iceland’s Stokksnes Peninsula

- Höfn, Iceland: The Lobster Town Self-Drive Guide

- Exploring Arnarstapi: A Self-Drive Guide

- A Guide to Iceland's Seasonal Foods for Your Road Trip

- Hverfjall Crater, Iceland: A Self-Drive Guide

- Self-Drive Guide to Visiting Askja

- A Self-Drive Guide to Visiting Kerlingarfjöll

- A Self-Drive Guide to Gunnuhver Geothermal Area

- Skriduklaustur, Iceland: A Self-Drive Guide to History & Culture

- Your Ultimate Guide to Visiting the Blue Lagoon in Iceland

- Borgarnes, Iceland: Top Things to Do & Self-Drive Guide

- A Guide to Glaciers in Iceland

- Car Rental Insurance in Iceland: What’s Usually Included, What’s Not & How to Choose

- Best Car Models for Iceland’s Terrain: Recommendations by Route

- Solo Traveller’s Guide to Self-Driving in Iceland

- Exploring Iceland’s Arctic Circle: What to See and Do

- How to Plan a Budget-Friendly Road Trip in Iceland

- The History of Iceland’s National Day: A Self-Drive Celebration

- Where to Spot Whales in Iceland: A Self-Drive Guide

- The Diamond Circle vs. The Golden Circle: Which Route is Right for You?

- Embracing a Greener Journey: Sustainability in Iceland

- Granni: A Self-Drive Guide to Iceland’s Neighboring Waterfall

- Háifoss: A Self-Drive Guide to Iceland’s Tallest Waterfall

- Iceland's Best Camping Spots for Road Trippers

- Gjáin: A Self-Drive Guide to Iceland’s Hidden Oasis

- Iceland's Hidden Waterfalls: Beyond the Tourist Trails

- Hjálparfoss: A Self-Drive Guide to Iceland’s Helping Falls

- Seasonal Self-Drive Itineraries in Iceland: What’s Open When?

- Kirkjufell: A Self-Drive Guide to Iceland’s Most Photographed Mountain

- Fjallabak Nature Reserve: A Self-Drive Guide to Iceland’s Rugged Highlands

- Hrafntinnusker: A Self-Drive and Hiking Guide to Iceland’s Obsidian Wilderness

- When to Visit Iceland: Northern Lights and Ice Caves vs. Hiking and Highland Adventures

- Visiting Laugarvatn Fontana Spa with a Rental Car: A Relaxing Icelandic Getaway

- Hvítserkur Rock: A Self-Drive Guide to Iceland’s Dragon of the North

- Skiing in Iceland: A Self-Drive Guide for Winter Adventurers

- Visiting the Mývatn Nature Baths by Car: A Self-Drive Guide

- Visiting Vök Baths in East Iceland: A Self-Drive Guide

- Visiting Skútustaðir Pseudo-Craters: A Self-Drive Guide

- Visiting Hljóðaklettar: A Self-Drive Guide on the Diamond Circle

- The Ultimate Guide to Exploring Reykjavik with a Rental Car

- Visiting Seljavallalaug: A Hidden Gem in South Iceland

- Guide to Sólheimajökull Glacier by Iceland Car Rental

- Eyjafjallajökull: Iceland’s Glacier Volcano

- Ísafjörður, Iceland: Your Ultimate Self-Drive Guide to the Westfjords

- What Continent is Iceland In? A Traveler's Guide

- Katla Volcano: A Guide to Iceland's Sleeping Giant

- The Magic of Icelandic Water: A Traveler's Guide

- A Guide to Exploring Akureyri by Rental Car

- A Self-Drive Guide to the Krafla Volcanic Region

- 12-Day Iceland Self-Drive: The Complete Itinerary

- Hekla Volcano: A Self-Drive Guide to Iceland's Gateway

- Visiting Deildartunguhver: A Self-Drive Guide to Europe’s Most Powerful Hot Spring

- Exploring Borgarfjörður: A Self-Drive Guide to West Iceland

- Exploring Stórurð: A Self-Drive and Hiking Guide to East Iceland

- Visiting the Forest Lagoon in North Iceland: A Self-Drive Guide

- Driving in Iceland in December: Embrace the Winter Wonderland

- Exploring Grábrók: A Self-Drive Guide to Iceland’s Volcanic Crater

- Exploring Látrabjarg: A Self-Drive Guide to Iceland’s Westernmost Point

- Iceland Car Hire Tips for UK Drivers: What You Need to Know

- 4-Day Iceland Winter Itinerary: The Best of the South

- Mount Mælifell: Iceland’s Emerald Volcano

- How Long to Drive Around Iceland? A Self-Drive Guide

- Driving in Iceland in January

- Exploring Djúpavík: A Self-Drive Guide to Iceland’s Remote Westfjords

- What to Wear in Iceland: Tips for Every Season

- Things to Do in Stykkishólmur: A Self-Drive Adventure Through Iceland’s Magical West

- The Secret Lagoon: Iceland’s Hidden Gem of Relaxation and Discovery

- The Silver Circle of Borgarfjörður: Your Ultimate Self-Drive Guide

- Snæfellsjökull: A Journey to Iceland’s Glacier of Legends

- Car Rental Iceland 4x4: Best 4WD Options for Your Trip

- What to See in Iceland: 20 Places You Don’t Want to Miss

- How to Prepare for an Iceland Road Trip

- Your Guide to Visiting Fagrifoss Waterfall by Car

- Exploring Stakkholtsgjá Canyon: A Self-Drive Adventure in Iceland

- Kolugljúfur Canyon: A Guide to Iceland's Hidden Gem

- Exploring Kvernufoss: A Hidden Gem in South Iceland

- Skógar Museum: A Journey Through Iceland's History

- 2 Days in Iceland: The Perfect Itinerary

- Exploring Berserkjahraun: A Self-Drive Guide to Iceland’s Lava Fields

- Driving in Iceland in February: Your Complete Guide

- Iceland Daylight Hours by Month: Planning Your Trip

- Petra’s Stone Collection: A Self-Drive Gem in East Iceland

- Iceland's New Kilometer-Based Road Tax: Everything You Need to Know

- Krýsuvíkurbjarg Cliffs: Self-Drive Guide to Iceland’s Wild Coast

- Brimketill: The Reykjanes Peninsula’s Natural Lava Pool

- Exploring Eldhraun Lava Field: A Self-Drive Guide to Iceland’s Volcanic Marvel

- Iceland 2026 Car Rental Guide

- Choosing the Best 4x4 for Iceland's Westfjords

- How Sagas and History Shape Iceland's Driving Routes

- Driving in Iceland After Dark: How to Plan Safe Evening & Night Drives

- What to Do When Roads Close in Iceland: A Traveller’s Plan B Guide

- Iceland With a 2WD Only: No‑Gravel, No F‑Road Itineraries

- Iceland Through the Windshield: Landscapes You’ll See Without Leaving the Car

- Iceland EV Road Trips Made Easy (2026 Guide)

- Iceland Speed Cameras & Fines: The 2026 Driver’s Guide for Visitors

- 24 Hours in Iceland (KEF Layover): Two Seasonal Micro-Itineraries by Car

- Self-Drive Iceland for First-Timers: A Realistic Day-by-Day Pace Guide

- The Complete Self-Drive Guide to Fjallsárlón Glacier Lagoon

- Route 60 Westfjords Road Trip: Dynjandi, Þingeyri & New Tunnels Explained

- Baldur Ferry With a Rental Car: Stykkishólmur ↔ Brjánslækur

- Iceland at Easter: 5‑Day Self‑Drive Itinerary from KEF

- Westman Islands by Rental Car + Ferry: Day Trip from the South Coast

- Reykjavík Northern Lights Pull-Outs: Safe Self-Drive Spots within 45 Minutes of the Capital

- Staying Connected: Best SIM Cards and Wi-Fi Options for Your Iceland Road Trip

- The "Gas & Go" Logistics Guide: How to Pay for Gas in Iceland Without Getting Stranded

- Iceland Wind Guide for Drivers

- Fjallsárlón vs Jökulsárlón: Which Glacier Lagoon to Visit by Car?

Car Rental Tips

Iceland's New Kilometer-Based Road Tax: Everything You Need to Know

29.12.2025

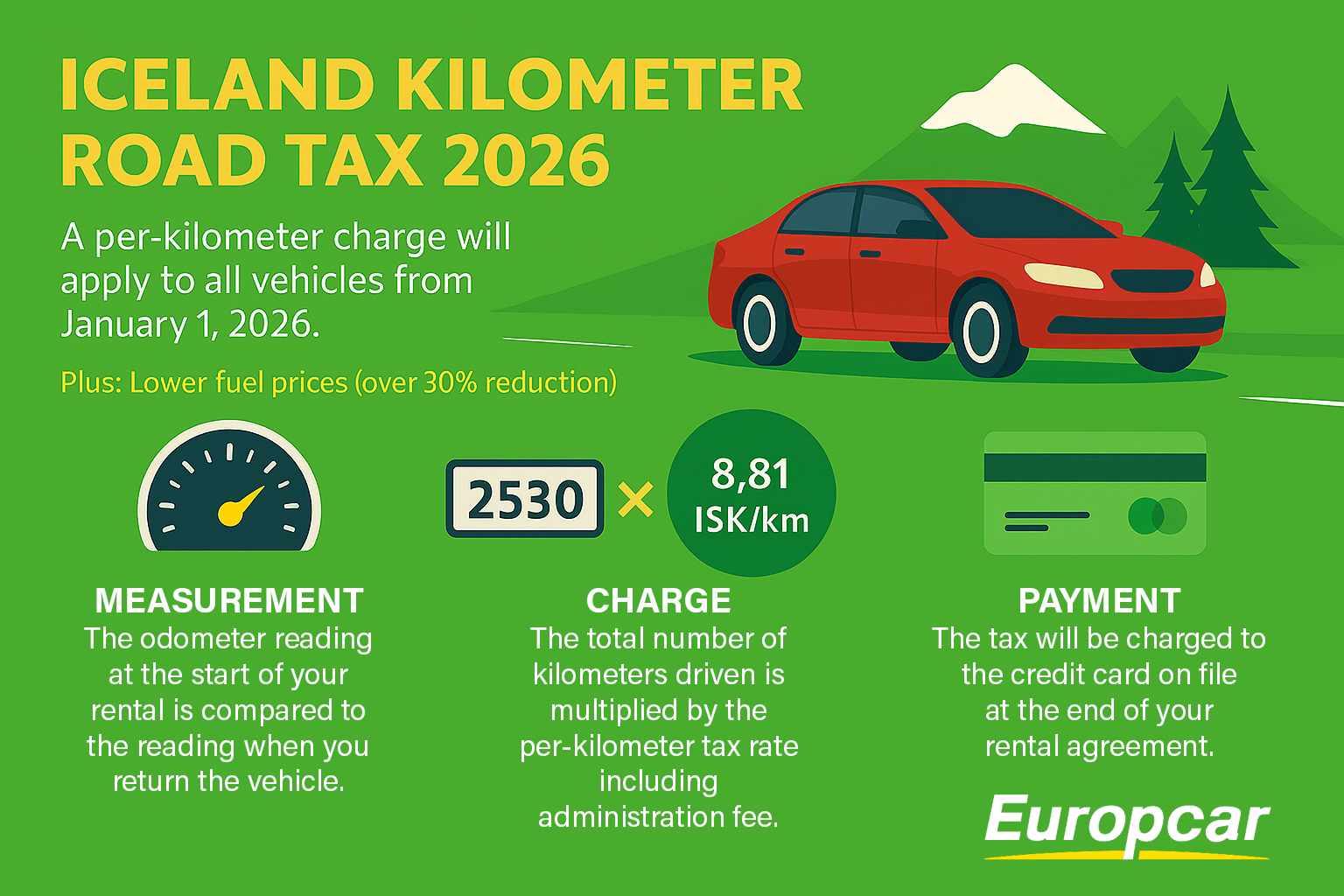

Planning a road trip around Iceland’s stunning Ring Road or exploring the hidden gems of the Westfjords? If your travel dates fall on or after January 1, 2026, there is an important update regarding driving regulations you need to know.

The Icelandic government is introducing a new kilometer-based road tax system. This change shifts how drivers pay for road usage, moving away from fuel-based taxation to a fairer system based on actual distance driven. For our customers at Holdur - Europcar Iceland, this means a slight adjustment to how rental costs are finalized, but it also comes with good news at the fuel pump.

This guide breaks down exactly what the new regulation entails, how it impacts your rental experience, and what you can expect when you hit the road in 2026.

Understanding the New Road Tax Regulation

Effective January 1, 2026, Iceland introduced a new per-kilometer road tax applicable to all vehicles, spanning electric and plug-in hybrid (PHEV) models as well as traditional petrol and diesel cars. With the per-kilometer charge, payment is based on actual road usage, measured by kilometers driven rather than fuel consumption.

The philosophy behind this change is modernization and fairness. As vehicles become more efficient and electric cars become more common, fuel taxes alone no longer cover the cost of maintaining Iceland’s extensive road infrastructure. This new system ensures that every vehicle contributing to wear and tear on the roads—whether it runs on electricity, diesel, or petrol—pays its fair share.

Which Vehicles Are Affected?

The short answer is: all of them. The new regulation applies to every passenger vehicle regardless of its power source.

Whether you rent a compact electric vehicle (EV) for city driving in Reykjavík, a rugged diesel 4x4 for the Highlands, or a plug-in hybrid (PHEV) for a mix of efficiency and range, the kilometer tax applies.

How the Tax is Calculated

The calculation is straightforward. You pay for what you use. The tax is determined solely by the distance you drive during your rental period.

- Measurement: The odometer reading at the start of your rental is compared to the reading when you return the vehicle.

- Charge: The total number of kilometers driven is multiplied by the per-kilometer tax rate.

- Payment: This fee is handled as a separate charge, processed via your credit card at the end of your trip.

The Current Tax Rate Explained

For vehicles and SUVs up to 3.5 tons, the total kilometer-based charge is made up of two components:

|

Item |

Rate (per kilometer) |

|---|---|

|

Government Road Tax |

ISK 6.95 |

|

Holdur Administration Fee |

ISK 1.50 (ISK 1.86 including VAT) |

- Government Road Tax: This fee is set by the Icelandic government and applies to all road users.

- Holdur Administration Fee: This covers the necessary operational costs for processing payments, submitting mileage reports, and ensuring full compliance with local regulations. The fee including VAT is ISK 1.86 per kilometer.

These charges are displayed on your final invoice to provide complete transparency, allowing you to see precisely how your road usage costs are calculated during your rental.

A Practical Example

Let’s say you rent a car for a 10-day trip around the Ring Road and drive a total of 1,500 kilometers.

- Total Distance: 1,500 km

- Rate: ISK 8.81 / km

- Total Tax Calculation: 1,500 * 8.81 = ISK 13,215

At the end of your trip, a pre-authorization charge will be applied to your credit card. The tax is calculated based on the distance driven during your rental. Please note that it may take up to five business days for the pre-authorization hold to be released and the remaining balance returned.

Good News: Significant Drops in Fuel Prices

While the introduction of a new tax might sound like an added expense, the Icelandic government has structured this change to balance out for drivers. To offset the new kilometer tax, specific excise duties on fuel have been removed.

This results in a significant reduction in the price you pay at the pump. When you fill up your rental car, you will notice that the cost per liter is considerably lower than in previous years.

Estimated Savings at the Pump

The removal of these duties leads to approximate price decreases as follows:

- Petrol: A decrease of approximately ISK 94 per liter (roughly EUR 0.64 / USD 0.75).

- Diesel: A decrease of approximately ISK 87 per liter (roughly EUR 0.59 / USD 0.69).

This reduction helps balance the overall cost of operating a vehicle. While you will pay a fee at the end of your rental based on mileage, your daily running costs for fuel will be significantly lower.

How This Impacts Your Holdur Rental

At Holdur, we strive to make every step of your journey seamless. Here is how we are integrating this new regulation into our rental process to ensure it is easy for you.

1. Transparent Billing

When you book your car, the base rental price remains the same. The kilometer tax is not a hidden fee but a government-mandated post-rental charge. We will clearly outline this during the booking and pick-up process so there are no surprises.

2. Automatic Processing

You do not need to register with any government agency or fill out complex tax forms. We handle the administration for you. We record the odometer reading when you pick up the car and again when you drop it off.

3. Payment Method

The tax will be charged to the credit card on file via pre-authorization at the end of your rental agreement. This happens automatically when we close out your contract, ensuring you don't have to worry about making a separate manual payment.

Why the Change Matters for Iceland

Iceland is known globally for its pristine nature and commitment to sustainability. This new tax structure supports those values.

By moving to a kilometer-based system, the country secures necessary funding for road maintenance and improvements without penalizing the adoption of eco-friendly vehicles. Electric vehicles, which previously paid little toward road upkeep because they don't use fuel, now contribute fairly.

Furthermore, by lowering fuel costs, the government is reducing the immediate financial burden of filling up the tank, making the transition smoother for those driving traditional combustion engine vehicles.

Summary for Travelers

Driving in Iceland is truly special, and our goal is to handle the administrative details so you can focus on exploring the country’s natural wonders. Here’s what to keep in mind for rentals starting January 1, 2026:

- Lower Fuel Costs: Take advantage of notably reduced prices for petrol and diesel at service stations.

- Pay-Per-Kilometer: The government road tax plus administration fee is calculated at ISK 8.81 per km for your rental’s total mileage.

- Automatic Payment: Holdur will calculate and process this km-based fee using your credit card at the end of your rental.

Please note that the kilometer tax does not cover all driving-related expenses. You will still need to pay for other costs, such as tunnel tolls (like the Vaðlaheiðargöng tunnel), parking, entrance fees for attractions, and any traffic fines you may receive.

This system supports sustainable travel while ensuring fair and reliable road funding. If you have questions about how these charges apply to your booking, our team is always available to provide assistance.

Safe travels and enjoy the drive!